Part 3: A Practical Omnichannel Maturity Guide for Regional Grocers

By Matt Van Gilder, VP Omnichannel, NexChapter

Most regional grocers aren’t falling behind because they lack ambition or technology. They’re struggling because their omnichannel operating model was never rebuilt to support the growth they layered on over time.

A Practical Omnichannel Maturity Guide for Regional Grocers reframes omnichannel challenges as a leadership and sequencing problem, not a digital one, and introduces a clear, executive-level framework to diagnose where cracks are forming before they become costly failures. Through the Omnichannel Maturity Grid, the guide helps leaders see whether their business is fragmented, overextended, or truly positioned to scale, and, more importantly, what to fix first.

If your teams feel stretched, initiatives stall, or AI and retail media aren’t delivering on their promise, this guide offers clarity, prioritization, and a path forward grounded in real-world grocery operations.

Read the guide and take the Omnichannel Maturity Assessment below.

Rebuilding Clarity

Most regional grocers are not immature. They are misaligned.

You did not get here by accident. You added channels because customers demanded them. You partnered with marketplaces because reach mattered. You launched retail media because margins were under pressure. Each decision made sense at the time.

But no one rebuilt the operating model underneath. Now you are running four distinct businesses inside one business. They were never designed to work together. This is not a technology problem. It is an operating model problem.

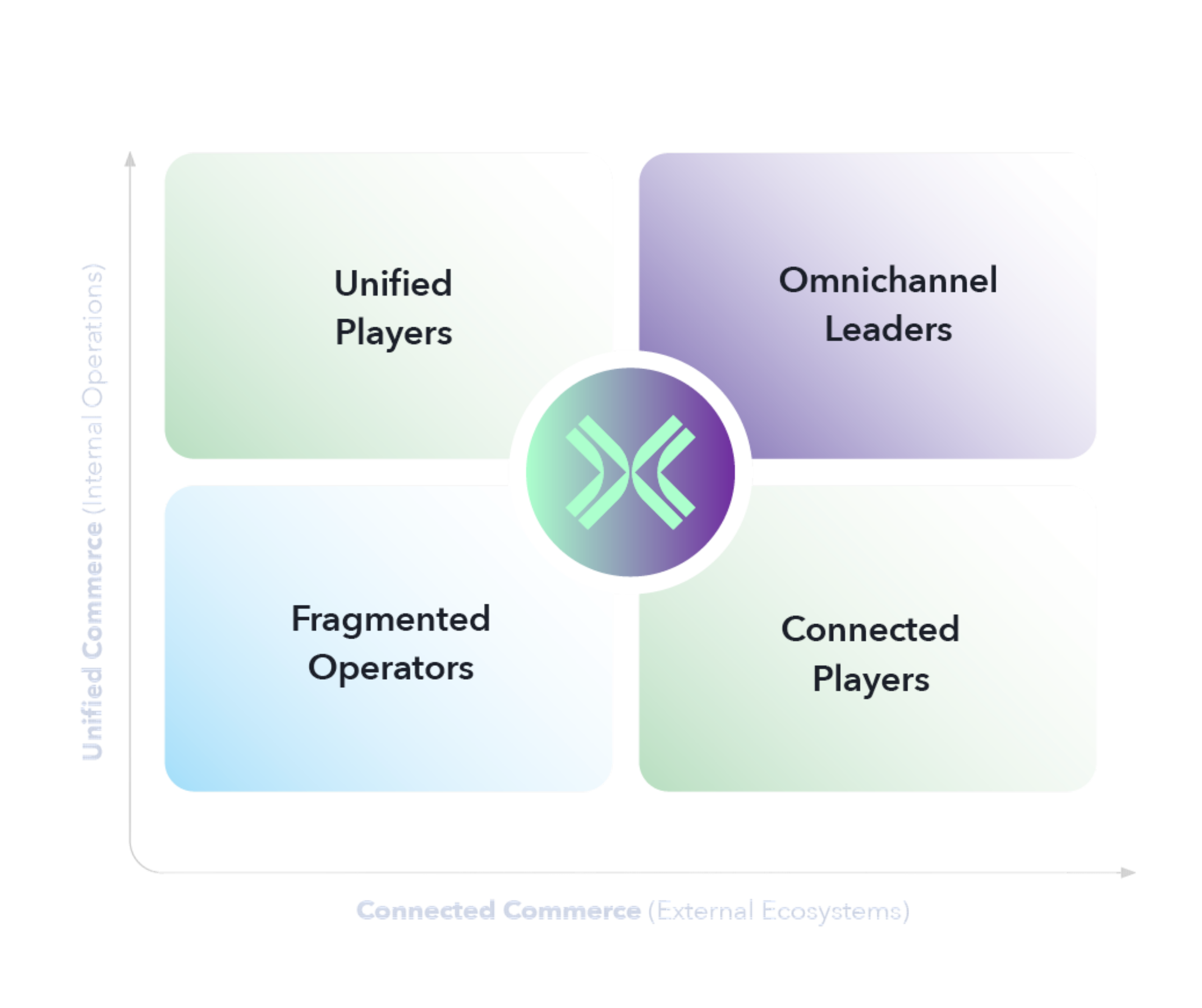

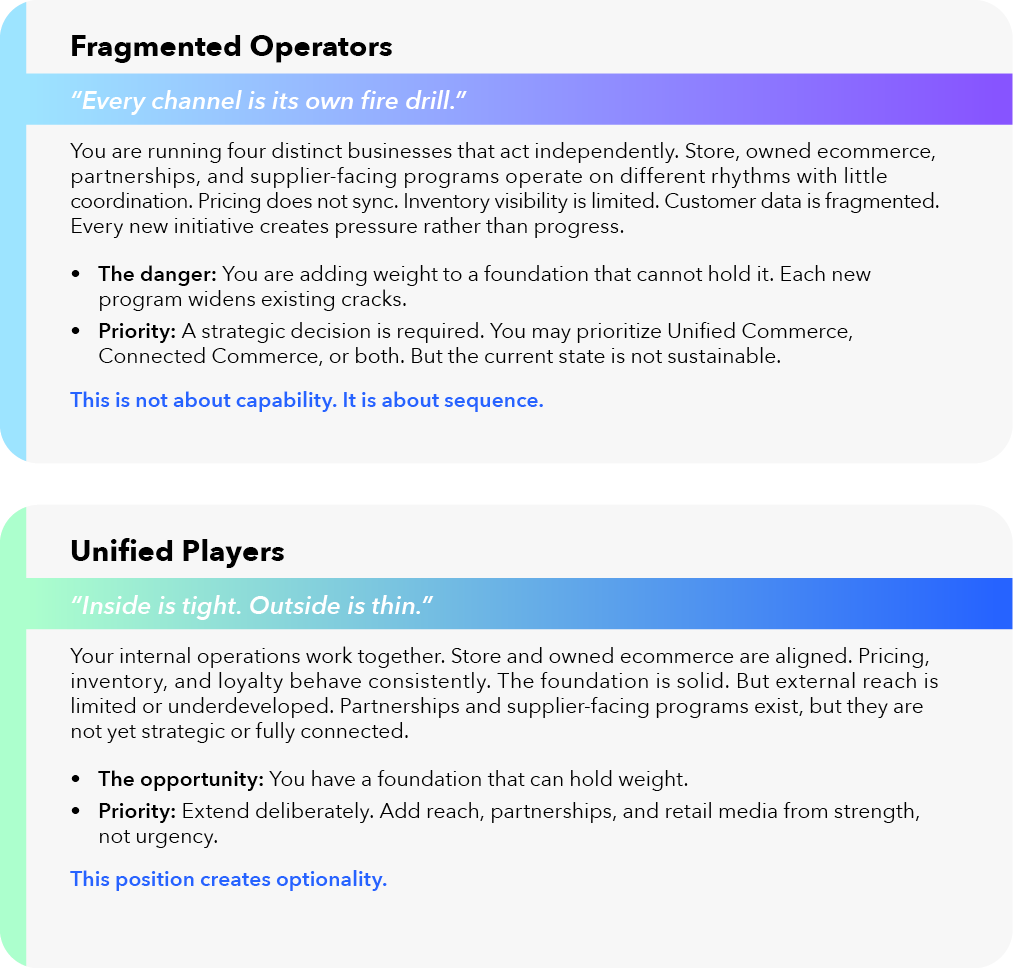

The Omnichannel Maturity Grid helps you see where you stand across two dimensions: Unified Commerce (how well your internal operations work together) and Connected Commerce (how strategically you engage external ecosystems).

The grid is not a scorecard. It is a prioritization tool. It shows you what to fix first and what to delay until the foundation holds.

The Operating Model Problem

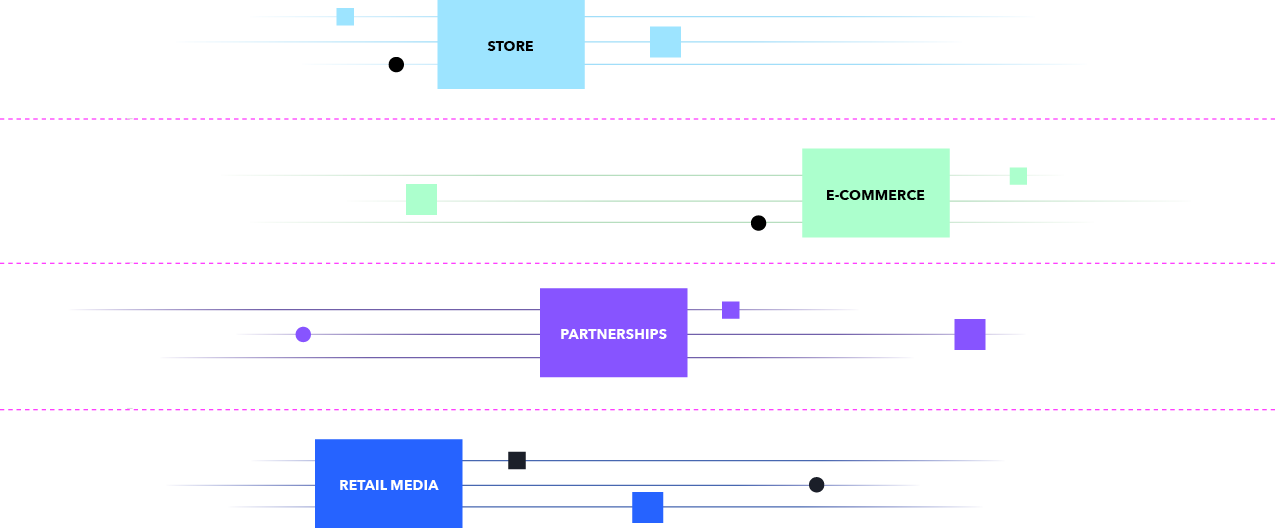

Walk into any regional grocery operation and you will find four businesses running in parallel:

The store: The foundation of the business. Where customers form impressions, where service and fresh matter most, and where culture and labor live. The store anchors the P&L and the brand experience. If the store does not work, nothing else does.

Owned ecommerce: The digital extension of the store, operating on a different cadence. Pickup and delivery introduce new expectations around timing, accuracy, substitutions, and communication. What appears simple requires coordination the traditional store was never designed to support.

Partnerships: Marketplaces like Instacart and DoorDash, and savings platforms like Fetch and Ibotta, expanded reach and volume as digital commerce grew. They help you serve customers you may not reach on your own. But they also sit between you and your customer, and between you and your suppliers, taking margin, data, and control.

Suppliers & retail media: The B2B side of the business. Traditional supplier relationships now coexist with retail media, which is built around audiences, content, and performance. Retail media brings real revenue potential, but it requires new skills and a proposition that can stand alongside national players.

Each evolved for good reasons. Each was stacked on top of what came before. No one asked whether the foundation could hold the weight. The result is what one industry analyst called a “giant hairball” of point-to-point integrations between siloed systems.

That is the problem. Not a lack of capability. Not a shortage of investment. A loss of clarity about what business you are actually running. This is not a digital problem. It is an operating model decision that belongs at the executive table.

Most omnichannel commerce efforts stall not because teams fail but because ownership is fragmented across digital, IT, merchandising, and operations with no single executive accountable for the operating model as a whole.

The stakes are real.

According to FMI and NielsenIQ, more than 90% of grocery consumers now shop both in store and online. This is no longer an edge case. It is the norm. FMI and NielsenIQ project U.S. online grocery sales will grow from $276 billion in 2024 to $388 billion by 2027.

Grocery Doppio research shows omnichannel shoppers spend 1.5x more than single channel shoppers and are nearly three times more loyal. They are your growth engine.

If your operating model is fragmented, you are leaking value from the customers who matter most.

Every initiative grocers care about now assumes a unified foundation. Retail media. AI. Automation. Margin recovery. All of it puts weight on a foundation that may already be cracking.

eMarketer reports Walmart controls 31.6% of the U.S. digital grocery market. Amazon controls 22.6%. Together they own more than half the digital grocery spend.

Regional grocers are not competing against each other anymore. They are competing against operators who solved the foundation problem years ago.

When You Hit the Wall

• Every regional grocer eventually hits the same wall.

• Online and in-store experiences diverge.

• Not by design, but because systems do not connect.

AI pilots stall because the data is fractured. Retail media underperforms. Store teams push back on digital initiatives because nobody prepared them.

Leadership asks the question: Why is this not working?

The answer is almost always the same. You built growth on top of a cracked foundation and expected technology to fix it.

This is not a future risk. This is happening now, in boardrooms across the industry. Delay is not neutral. Every quarter you wait, the foundation takes more weight.

• That is what the Omnichannel Maturity Grid provides.

• Not another checklist.

• A way to finally see clearly.

The Omnichannel Maturity Grid

Omnichannel commerce maturity is not about channel count. It comes down to two things:

• Unified Commerce: How well your internal operations work together (store, ecommerce, pricing, inventory, loyalty). Brick Meets Click data shows more than 70% of digital grocery sales still happen on owned channels. This is why Unified Commerce anchors the vertical axis.

• Connected Commerce: How strategically you engage external ecosystems (marketplaces, delivery partners, savings platforms, retail media). Are you building on a connected foundation, or piling complexity on top of it?

Where Do You Stand?

Most retailers recognize themselves in one of these four positions. Which one sounds most familiar to you and your operation?

What Omnichannel Leaders Do Differently

Wherever you stand on the grid, these patterns separate grocers who thrive from those who struggle:

AI Does Not Fix Fragmentation. It Exposes It.

AI is no longer optional in grocery. But it is also not a shortcut. The grocers who win with AI will not be the ones with the most pilots or the flashiest tools.

They will be the ones who unified first.

AI depends on clean data. Reliable signals. When the foundation is solid, AI compounds progress. When it is fragmented, AI accelerates the chaos. AI requires:

• Unified data

• Consistent processes

• Aligned operating models

Without these, it has nothing stable to build on.

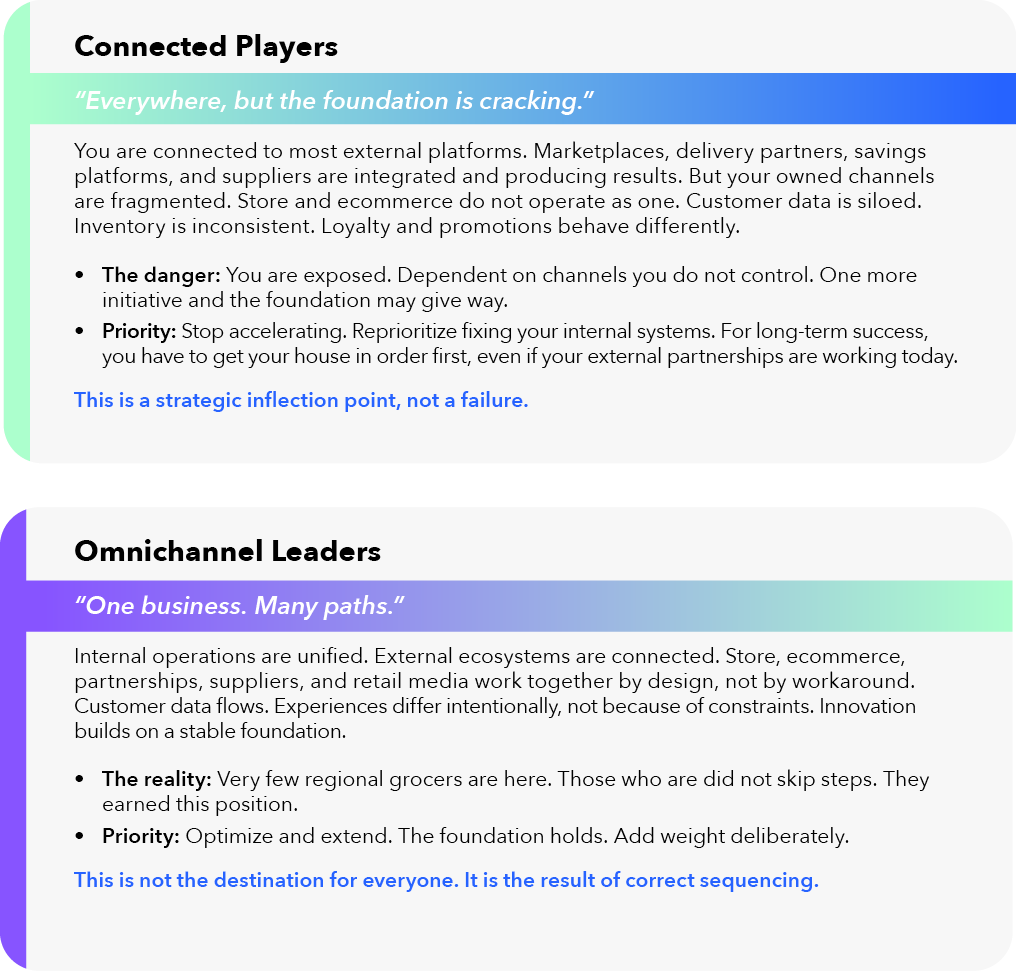

BCG found that 86% of grocery executives say AI will be a necessity. But only 26% have the capability to scale it beyond proofs of concept. The problem is not algorithms. Seventy percent of AI failure comes from fragmented processes, fragmented operating models, and fragmented ownership. We AI does not correct those issues. It makes them visible.

The Weight Is Increasing

As agentic AI moves from experimentation to real operational deployment, the tolerance for fragmentation drops sharply. Systems that once limped along under manual oversight will be stress-tested. Handoffs will break.

Data gaps will surface. Inconsistencies will multiply at machine speed.

Unified Commerce is an omnichannel commerce requirement and an AI prerequisite.

The longer you wait, the heavier the weight.

The Cost of Getting This Wrong

When initiatives fail, leaders ask what went wrong with the strategy. Usually, nothing.

The strategy was sound. The order wasn’t.

Customer Experience Suffers

Customers notice inconsistency faster than executives expect.

• Prices differ between store and app without explanation

• Promotions fail to carry across channels

• Loyalty points disappear or behave unpredictably

The cost: Lost lifetime value. Declining engagement.

The mistake: Investing in growth before fixing experience fundamentals.

Retail Media Promise Never Materializes

Retail media margins can reach 70 to 90 percent. The economics are transformational.

But only on a unified foundation.

• Requires unified customer data and closed loop measurement

• Fragmented identity leads to inconsistent targeting

• CPG partners ask harder questions every quarter

The cost: The margin promise erodes.

The mistake: Launching retail media before unifying data.

Partnership Model Weakens

Marketplaces can drive volume. They cannot build relationships for you.

• Partner data is partial and difficult to unify

• Loyalty and personalization cannot be owned

• Negotiating power erodes without first party strength

The cost: Dependence on channels you do not control.

The mistake: Treating partners as a substitute for owned capability.

Partnerships are for revenue, not loyalty.

Most omnichannel failures are not strategy failures. They are sequencing failures.

The right moves, made before the foundation was ready.

Who Do You Want to Be?

Where you stand on the grid reflects choices you have already made. Some were deliberate. Some were inherited. The grid makes both visible so you can decide what’s next. You may not be an Omnichannel Leader today. That is not a judgment. It is a starting point. But you do need to understand the tradeoffs of where you stand. Every position on the grid has consequences. The question is whether you are satisfied with the status quo, or ready to move forward.

See Where You Stand: Take the Assessment

This guide has laid out a way to understand and diagnose where you are. It has painted a picture of what the path forward could look like. But a picture is not a position. NexChapter works with regional grocers to help them understand where they stand and chart a course forward. To support that work, we created the Omnichannel Maturity Assessment.

The assessment captures your current state across six dimensions and a series of diagnostic questions:

• Customer profiling and segmentation

• Journey and experience design

• Technology and integration

• Activation and engagement

• Fulfillment and operations

• Measurement and enablement

NexChapter reviews your responses and benchmarks them against peer retailers. From there, we deliver a customized report showing where your foundation is solid, where pressure is building, and what to prioritize next.

Clarity, not comparison. Diagnosis and direction.

The Path Forward

The grocers who win will not be the ones with the most channels or the biggest budgets. They will be the ones who rebuilt the foundation: a shared understanding of what business they are running, where the pressure is building, and what to fix first.

This is not a problem for the digital team. This is not a problem for the technology team.

This conversation belongs at the executive table. CEO led. COO owned. CFO informed.

Without that alignment, every function adds weight and the cracks get wider.

Start here:

• Take the Assessment. Capture your current state. NexChapter benchmarks your responses and delivers a customized report.

• Request a Workshop. Turn your results into a prioritized action plan. Half day. Facilitated by NexChapter.

• Start a Conversation. If you already know where the cracks are, reach out.

Take The Omnichannel Maturity Assessment

If this framework helped you see your omnichannel challenges more clearly, download the guide to revisit the full maturity model, assessment lens, and prioritization guidance in one place.