Part 2: Where Clarity Cracked: How Regional Grocers Ended Up Running Four Businesses.

By Matt Van Gilder, VP Omnichannel, NexChapter; and Ken Kaufmann, VP Loyalty, NexChapter

For a long time, grocery ran on a rhythm everyone understood. The store was the operating model: one system, one cadence, one place where fresh, service, and the weekly ad shaped the business. When the store was right, everything else felt right.

But the reality many of us now recognize is this:

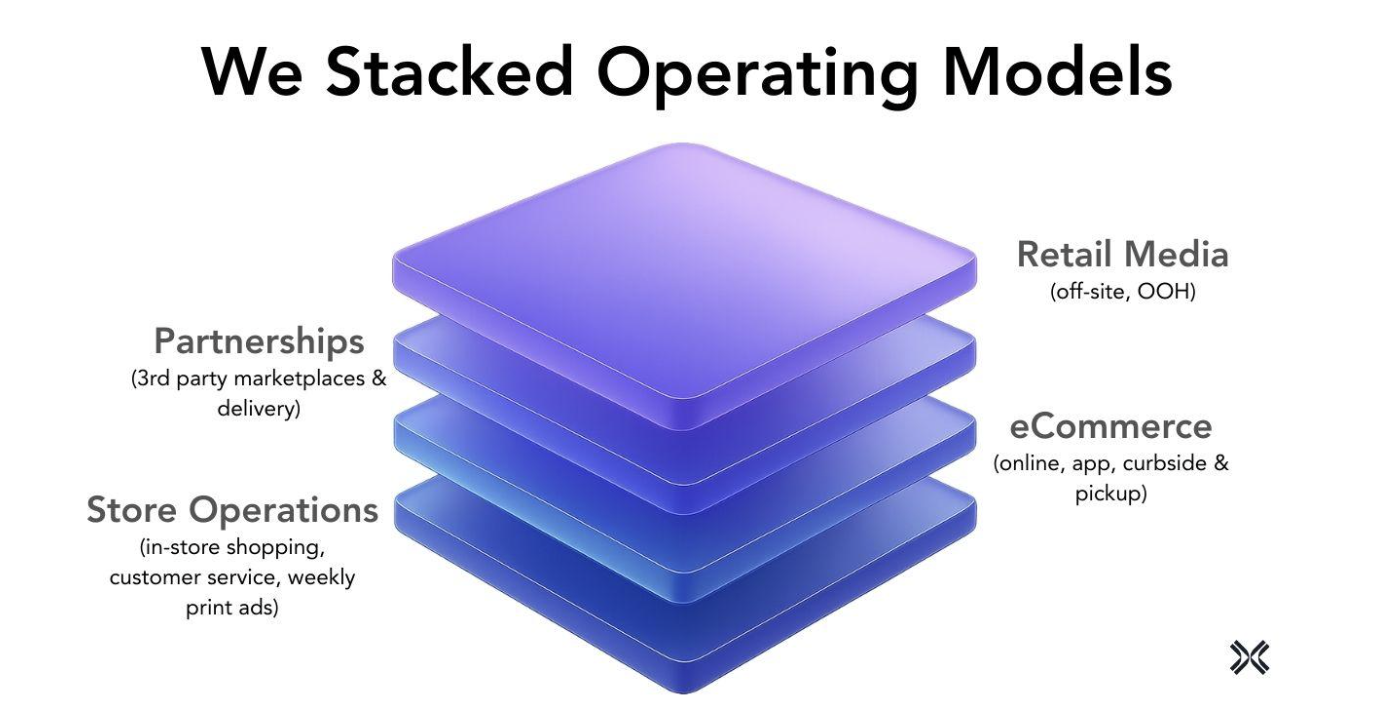

We didn’t just add channels. We stacked operating models on top of each other.

And the structure underneath never fully caught up.

Today, customers meet your business through apps, pickup routines, delivery partners, and media platforms — an expanding set of touchpoints. Each one filled a gap in the customer journey, but each brought its own rules, data, and expectations. Over time, what started as small additions hardened into parallel businesses.

Now, AI is raising the stakes. AI and automation don’t hide fragmentation. They expose it. Once exposed, those gaps get in the way of any meaningful automation.

That’s one reason leadership teams are stepping back. Not to slow down, but to make sure the next layer doesn’t sit on top of cracks they already feel.

How We Got Here

Most regional grocers were already building their ecommerce capabilities when three shocks hit: Amazon bought Whole Foods, Instacart’s marketplace scaled fast, and COVID turned ecommerce from optional to essential. Each shock forced retailers to move faster than the organization was ready for.

Decisions varied; marketplaces, owned ecommerce, hybrids, or waiting; because realities varied: capital, labor, tech, geography, and leadership philosophy. Different choices led to different end points, but the outcome was the same: the old store model fractured.

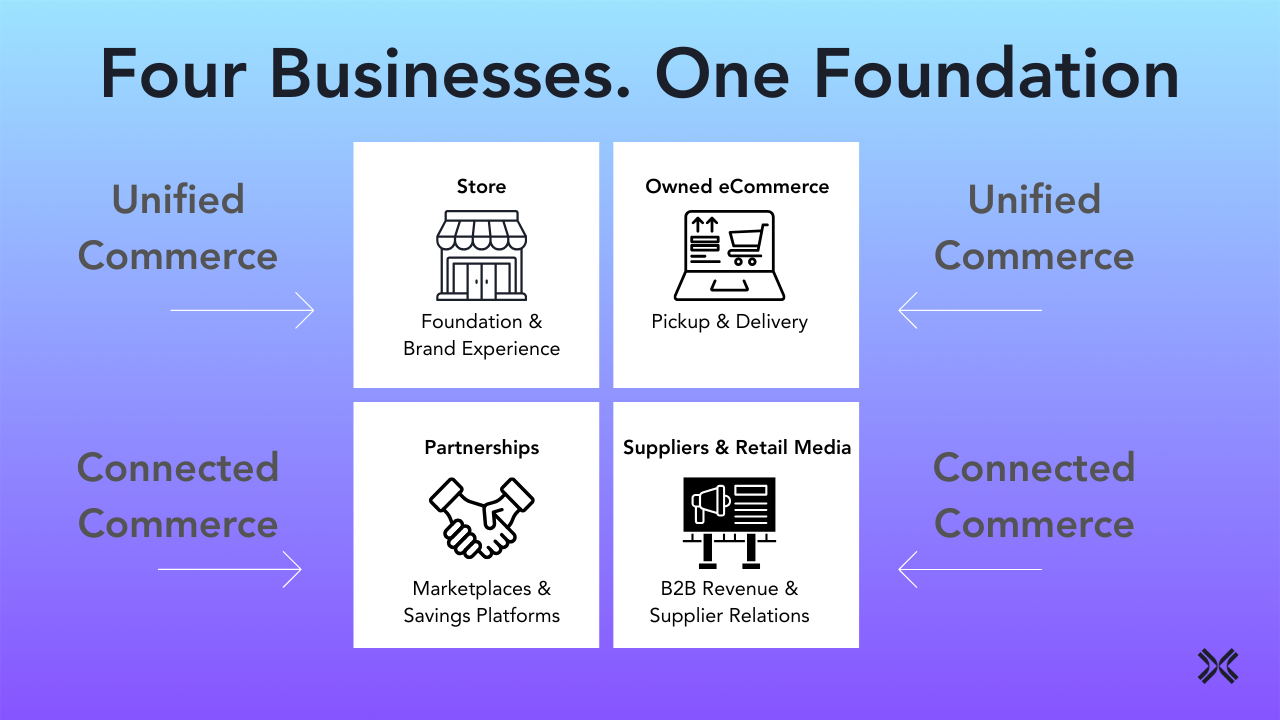

You’re Not Running One Business Anymore

Most regional grocers now run multiple businesses. Each business draws on the same stores, the same customers, the same data, and the same inventory — but each runs on different expectations and creates different pressure on the organization.

1. The store

This is the foundation. It is where customers form their impressions, where fresh and service show up, and where the culture and labor model sit. The store remains the anchor of the P&L and the place where the brand is experienced every day. If the store doesn’t work, nothing else will.

2. Owned ecommerce

This is the digital version of the store, but it runs on a different cadence. Pickup and delivery carry their own expectations for substitutions, timing, accuracy, and communication. Fees, substitutions, timing, accuracy, and communication all shape the experience long before an order reaches the aisles. What looks simple requires coordination the old store rhythm never had to support.

3. Partnerships

Marketplaces like Instacart and DoorDash and savings platforms like Fetch and Ibotta became part of the landscape as digital commerce grew. They deliver reach and volume, serving customers you may not reach on your own. But they also inserted themselves between you and your customer, and then between you and your suppliers. They take margin, data, and influence, and they run a business you do not control.

4. Suppliers & retail media

This is the B2B side of your company. One stream is the familiar but evolving commercial relationship with supplier sales teams. The other is retail media, a newer relationship with brand marketers built around audiences, content, attribution, and campaign performance. Retail media brings real revenue potential, but it requires new skills and a proposition that can stand next to national players.

These businesses were all built over time and layered onto a store-centric operating model and were never fully integrated, which is why they now pull against each other more than anyone intended. They also map to two fundamental capabilities discussed in Part 1 of this series. The store and owned ecommerce depend on unified commerce: internal systems, data, and teams working as one. Partnerships and suppliers & retail media depend on connected commerce: how strategically you extend into external ecosystems.

Most regional grocers are stronger in one dimension than the other. That gap is where the friction shows up for customers, stores, and partners.

Rebuilding Clarity Where It First Broke

If omnichannel is where clarity cracked, it’s also the first place to rebuild it. And the fix isn’t another round of tools or another layer of work.

The hard work is reconnecting rules, routines, data, and decisions that sit across the four commercial businesses you now run. Each one evolved on its own timeline. Each one made sense at the moment. But none of them were built to run as a single system.

Rebuilding clarity means pulling those pieces back together so the business runs on one version of the truth. One set of definitions. One set of expectations. One rhythm the whole organization can march to.

This is also how regional grocers prepare for AI, which will surface inconsistencies the moment you try to automate anything. With a unified foundation and a clear approach to connected commerce, AI becomes a practical advantage. Without it, AI becomes another layer sitting on top of the same cracks. Rebuilding clarity is not a project. It is a way of running the business — and the starting point for everything that comes next.

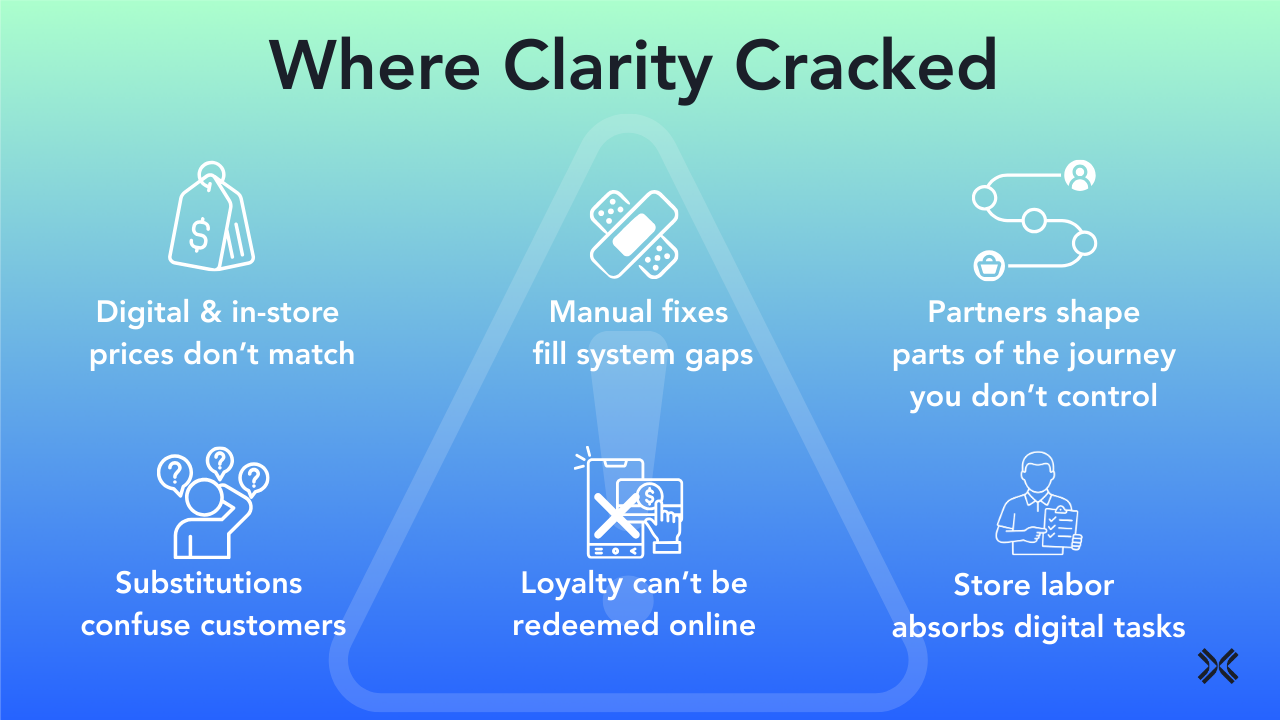

Where Clarity Cracked

The seams show up in familiar places:

Prices online and in-store do not match

You can’t redeem loyalty rewards everywhere

Substitutions make sense to the system but not to the customer

Partners shape parts of the journey you don’t control

Store labor absorbs new digital tasks without losing the old ones

Manual fixes fill the gaps where systems do not connect

If you’ve lived any of these, you’ve seen where clarity cracked. The issue is not any single system or partner. It’s that the work is scattered across too many versions of the same information. Item details, prices, offers, and expectations do not match up because every channel runs on its own logic.

Bringing those pieces back together into one omnichannel operating model.

Where To Start Looking

If you recognize the cracks in your own business, here are three questions worth asking:

Where are customers seeing something different online than they see in our stores, and why?

What decisions are we making without the teams who need to shape them?

Where does the work rely on manual fixes, heroics, or workarounds that would not scale?

These questions do not solve the problem. But they help you see where clarity cracked first. And that is where rebuilding starts.

The next step is not more tools or another initiative. It is seeing clearly where you stand. Part 3 of this series will introduce a framework to help regional grocers assess your position across unified and connected commerce, and decide where to move first. For now, the question is: Where are you seeing the cracks most clearly?